does indiana have a inheritance tax

Indiana does not have an inheritance tax nor does it have a gift tax. An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person.

Adler Estate Law Page 2 A Legal Blog Written By Indiana Lawyer Lisa M Adler

There is also an unlimited charitable deduction for inheritance tax purposes.

. Indiana does not have an inheritance tax nor does it have a gift tax. So the net effect was that high income and high asset people were moving to other states does lowering overall taxes. Indiana repealed the inheritance tax in 2013.

Indianas inheritance tax still applies. In Pennsylvania for instance there is an inheritance tax that applies to out-of-state inheritors. The Inheritance tax was repealed.

No tax has to be paid. Inheritance tax applies to assets after they are passed on to a persons heirs. Up to 25 cash back Indianas inheritance tax is imposed on certain people who inherit money from someone who was an Indiana resident or owned property real estate or other tangible property in the state.

How Much Is Inheritance Tax. Are required to file an inheritance tax return Form IH-6 with the appropriate probate court if the value of transfers to any beneficiary is greater than the exemption allowed for that beneficiary. Indiana repealed the inheritance tax in 2013.

There is no federal inheritance tax and only six states levy the tax. Here in Indiana we did have an inheritance tax and this is why some people assume that we are one of these states. There is also a tax called the inheritance tax.

States have typically thought of these taxes as a way to increase their revenues. An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person. However other states inheritance laws may apply to you if someone.

For individuals dying before January 1 2013. This is great news if you live in the Hoosier state. Indiana is one of 38 states in the nation that does not have an estate tax.

Indiana does not have an inheritance tax nor does it have a gift tax. Therefore no inheritance tax returns must be filed at this time. You do not need to pay inheritance tax if you received items from an Indiana resident who died after December 31 2012.

Whereas the estate of the deceased is liable for the estate tax beneficiaries pay the inheritance tax. Indiana repealed the estate or inheritance tax for all those who die after December 31 2012. The decedents surviving spouse pays no inheritance tax due to an unlimited marital deduction.

As a result of this weve included information on how the Indiana estate will manage your estate if you have a legal will as well as information on who is entitled to your property if. Indiana has a three class inheritance tax system and the exemptions and tax rates vary between classes based on the relationship of the recipient to the decedent. Inheritance tax usually applies if the decedent lived in one of those six states or if the property being passed on is.

However other states inheritance laws may apply to you if someone living in a state with an inheritance tax leaves you money or property. No inheritance tax has to be paid for individuals dying after December 31 2012. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed.

In general estates or beneficiaries of. However many states realize that citizens can avoid these taxes by simply moving to another state. As a result Indiana residents will not owe any Indiana state tax after this date with respect to transfers of property and assets at death.

There is no inheritance tax in Indiana either. There is no inheritance tax in Indiana either. As a result Indiana residents will not owe any Indiana state tax after this date with respect to transfers of property and assets at death.

Therefore no inheritance tax returns must be filed at this time. Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. Indiana Inheritance and Gift Tax.

There is no federal inheritance tax and only six states levy the tax. You do not need to pay inheritance tax if you received items from an Indiana resident who died after December 31 2012. Inheritance tax is collected when a beneficiary inherits money property or other assets after someone dies.

It doesnt matter how large the entire estate is. The tax rate is based on the relationship of the inheritor to the deceased person. Indiana inheritance tax was eliminated as of January 1 2013.

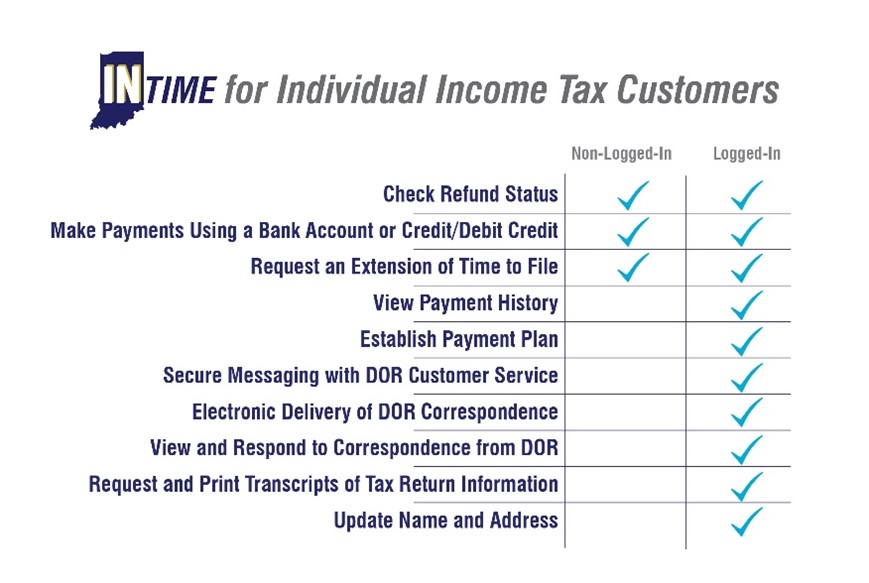

Dor Ready To Pay Your Quarterly Estimated Taxes Intime Can Help

Adler Estate Law Page 2 A Legal Blog Written By Indiana Lawyer Lisa M Adler

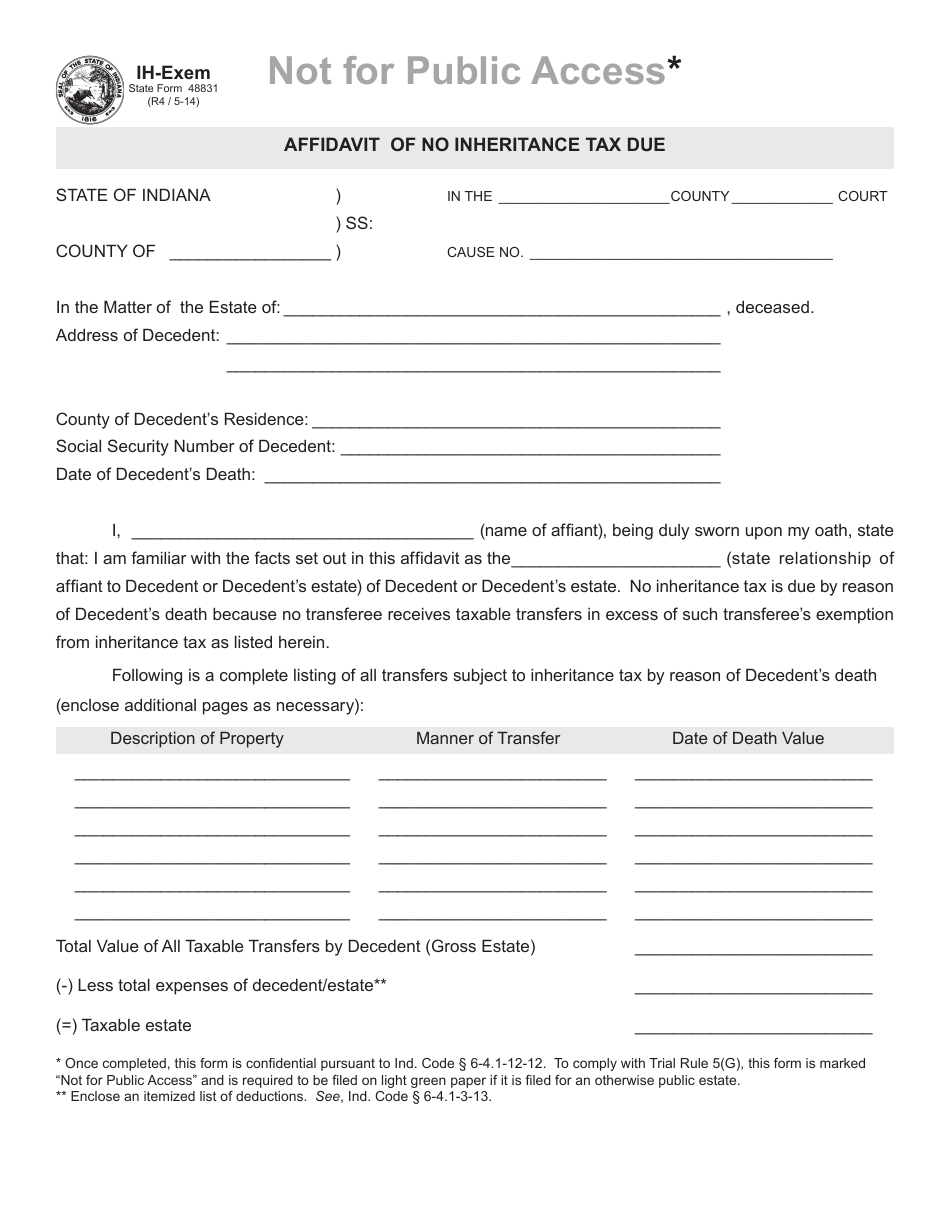

State Form 48831 Ih Exem Download Fillable Pdf Or Fill Online Affidavit Of No Inheritance Tax Due Indiana Templateroller

Calculating Inheritance Tax Laws Com

Adler Estate Law Page 2 A Legal Blog Written By Indiana Lawyer Lisa M Adler

Dor New To Intime Here S How To Get Started

Six Tips For Managing An Inheritance Wealth Management Blog

Do You Have To Pay Taxes On Inheritance All You Need To Know In 2022

California Inheritance Tax Inheritance Tax In California Lawyer Legalmatch

State Form 48831 Ih Exem Download Fillable Pdf Or Fill Online Affidavit Of No Inheritance Tax Due Indiana Templateroller

2022 State Tax Data State Debt State Revenue And State Tax Collections

Dor Ready To Pay Your Quarterly Estimated Taxes Intime Can Help

Estate And Inheritance Tax State By State Housing Gurus

Chart Of The Indiana Inheritance Tax Law 1915 Library Of Congress

Dor Ready To Pay Your Quarterly Estimated Taxes Intime Can Help

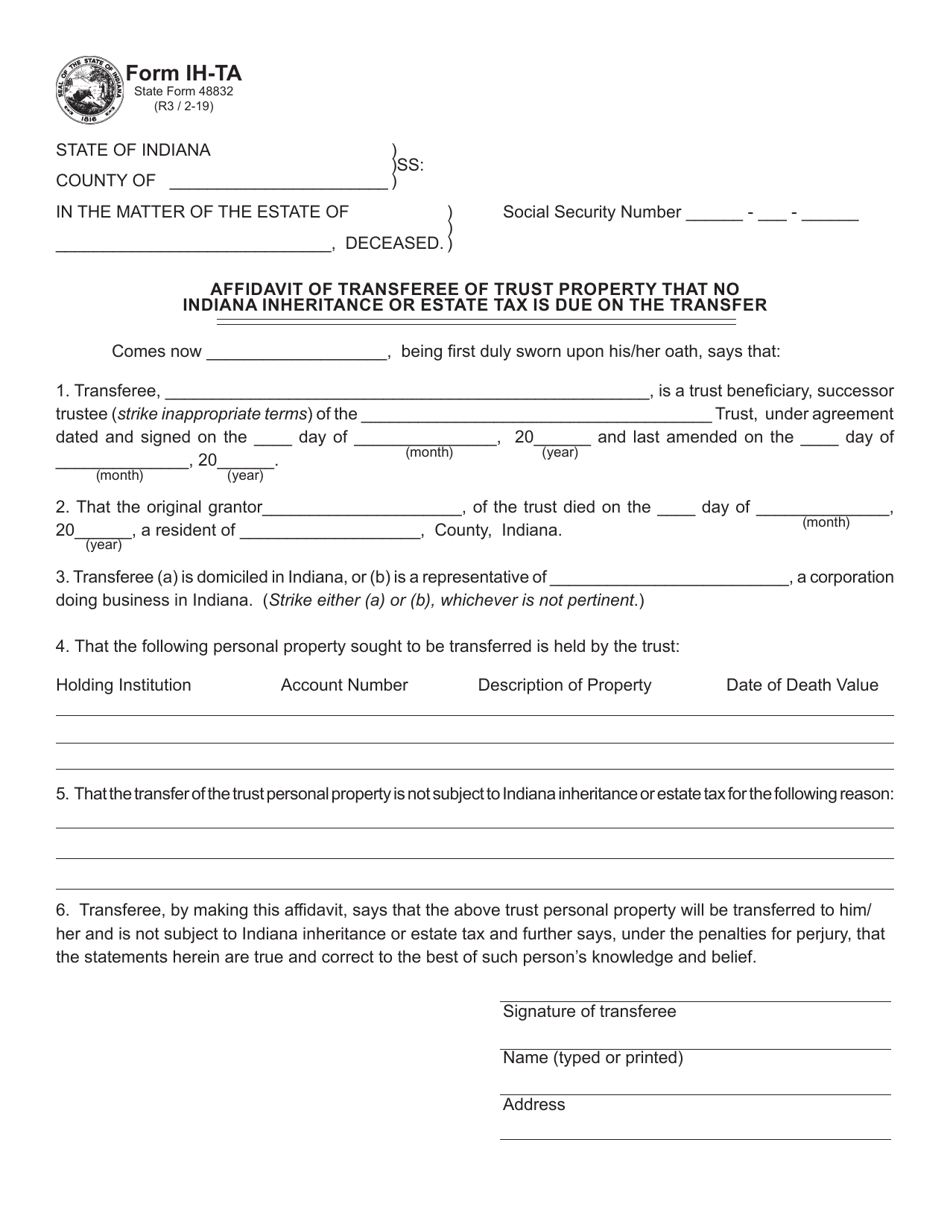

Form Ih Ta State Form 48832 Download Fillable Pdf Or Fill Online Affidavit Of Transferee Of Trust Property That No Indiana Inheritance Or Estate Tax Is Due On The Transfer Indiana Templateroller

Form Ih Ta State Form 48832 Download Fillable Pdf Or Fill Online Affidavit Of Transferee Of Trust Property That No Indiana Inheritance Or Estate Tax Is Due On The Transfer Indiana Templateroller

Fillable Online Ih 6 Not For Public Access Indiana Inheritance Tax Return Fax Email Print Pdffiller

Dor Ready To Pay Your Quarterly Estimated Taxes Intime Can Help